Saving the 18-hole public golf course makes financial sense - and how LITTLE benefit is delivered by destroying the course…

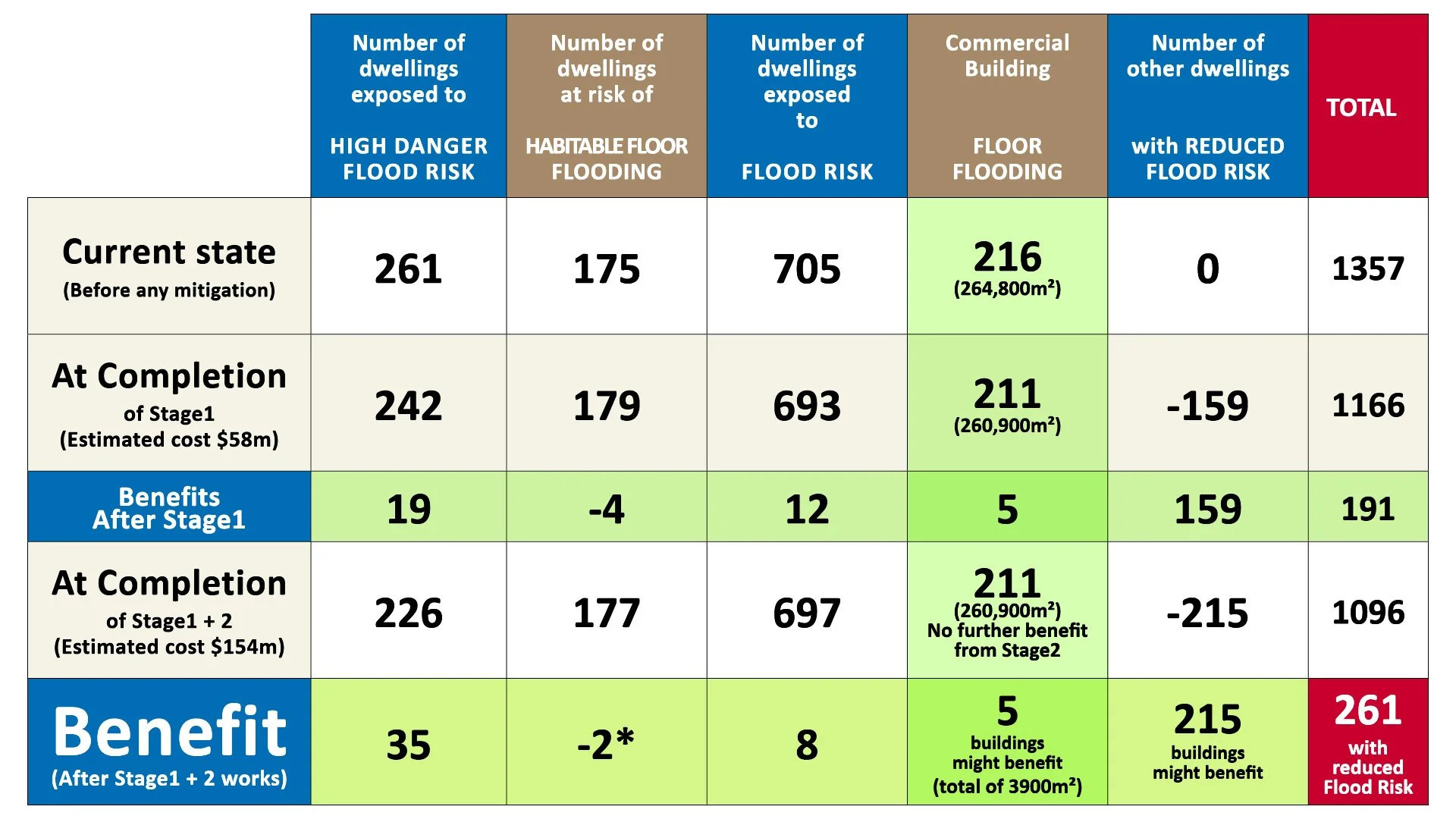

The numbers shown above are from the Healthy Waters business case.

The small numbers across the bottom-line

show just how ineffective this healthy waters scheme is.

261 Properties are shown

to receive some level of benefit from the scheme

...of this number, 215 are only receiving the nominal benefit

of “100mm or more” (“Reduced Flood Risk”)

The Takapuna Public Golf Course provides a recreational asset at no cost to council, or the community.

This is unlike many other recreational facilities that Auckland Council provides such as playing fields, football fields, swimming pools and many indoor facilities that require council to provide capital and/or annual operating support.

Since taking over the golf course when it was in liquidation almost 17 years ago, the Takapuna Golf Course has invested substantially each year, making improvements to the course, the driving range and the buildings, including the cafe and pro-shop. Previously, parts of the course were unplayable, due to wet conditions underfoot.

This contrasts today, with a course that is playable almost every day of the year, rain or shine.

This investment has amounted to millions of dollars to date. A full return on this investment has yet to be realised.

The maintenance costs that Auckland Council saves are currently $476,000 per annum and increase each year.

The annual rates paid to Council are $65,000 and increase each year.

The lease and share of revenue is $279,000 currently and increases each year - especially with the ongoing popularity of the upgraded golf course and driving range.

This enables a truly public golf course that is financially accessible. An 18-hole round of golf costs $40 and for a Gold Card holder the cost reduces to $30 - this makes for both an affordable entry level to the sport, as well as an affordable day of health and recreation for the elderly.

Net Present Value (NPV) is a financial metric

NPV is used to measure the value of future cash flows in today’s terms. It accounts for the time value of money — the idea that a dollar today is worth more than a dollar in the future — by discounting future income or costs back to present value using a set discount rate (e.g. the NZ Treasury rate of 2%).

In the case of Takapuna Golf Course, which leases land from Auckland Council, the annual lease revenue increases over time through inflation adjustments and/or rising revenue. This creates a compounding effect, meaning the longer the asset is held, and the more lease payments grow, the higher the NPV. As a result, NPV highlights the growing opportunity cost of removing the golf course.

Over a 30-year period, the opportunity cost of not operating or maintaining the Takapuna Golf Course is estimated to have a Net Present Value of $75.6 million, as detailed in the table below.

A further financial analytical tool is a Benefit-Cost Analysis. The would include the financial benefits associated with the golf course. A number of studies demonstrate positive economic effects of a golf course. These include the dollars that golfers spend on equipment, clothing, accessories and sustenance.

There is also the money that golfers pay in travel and at the local businesses close to the course

In addition there is also the financial gain from the employment of some 40 employees as well as spending on purchases and supplies for the cafe, the pro-shop, maintenance and related equipment.

The Government receives revenue from the golf course through GST and Income Tax.

There is a fiscal multiplier that can be applied as the money generated by the golf course enhances further economic activity, in the local economy.

We are currently developing this aspect of benefit cost and will be updating this section.

In addition there are known health benefits, both physical and mental, associated with playing golf. There are a number of studies that are informing this aspect of a benefit cost. A further aspect is the benefit cost associated with the flood storage. This will be on a par with the work undertaken by Auckland Council.

From a cost perspective there is the issue of any additional maintenance associated with a wetland. The RE-CONTOURING SOLUTION is considerably cheaper to build, operate and maintain over the long term.

With wetlands, the many weed species present, especially those with airborne seed dispersal, and the presence of known aquatic weeds within the catchment, we expect ongoing continuous maintenance.

Our ecological experts are currently refining these costs realistically. Due to the presence of many weed species, especially those with airborne seed dispersal and the presence of known aquatic weeds within the catchment, we expect ongoing continuous maintenance.

Because many forms of chemical control are disallowed in water courses, it is likely that weed control must be manual. This is time consuming and expensive.

Aquatic weed control is especially difficult due to the rapid growth rate of aquatic species and the introduction of new species to this location.

There is also the operational cost associated with maintaining water levels, especially over summer, when the existing ponds on the golf course dry out completely. Associated with this, will be the costs of attending to botulism amongst birds, especially ducks, as the toxins in the water increase over summer.

There will also be the costs of treating midge infections which occur at other urban wetland locations in Auckland. The cost of treating a mosquito infestation is also a likelihood because of the close proximity of homes and businesses and the large number of park users including at the adjacent Eventfinda Stadium. Due to the built up nature of the area, it is likely that a rapid response will be required.

Our ecological experts are providing some qualitative and quantitative costs.

Clearly a reduction in the size of the golf course and the economic activity outlined above, associated with it, amounts to a very significant cost, which escalates in terms of its net present value.